- #Instay form estimates and invoice pro how to#

- #Instay form estimates and invoice pro pro#

- #Instay form estimates and invoice pro professional#

- #Instay form estimates and invoice pro download#

- #Instay form estimates and invoice pro free#

#Instay form estimates and invoice pro pro#

It also has additional details usually left out of a pro forma invoice. It allows the buyer to clear the supplier’s dues and use them for taxation purposes. In contrast, a commercial invoice is a bill containing all the relevant information during the order process. In case of gifts or goods not meant for sale or purchase, a pro forma invoice takes the place of a tax invoice and is the primary shipping document. If the company uses the pro forma invoice for customs, they must produce the tax invoice within 120 days.

#Instay form estimates and invoice pro how to#

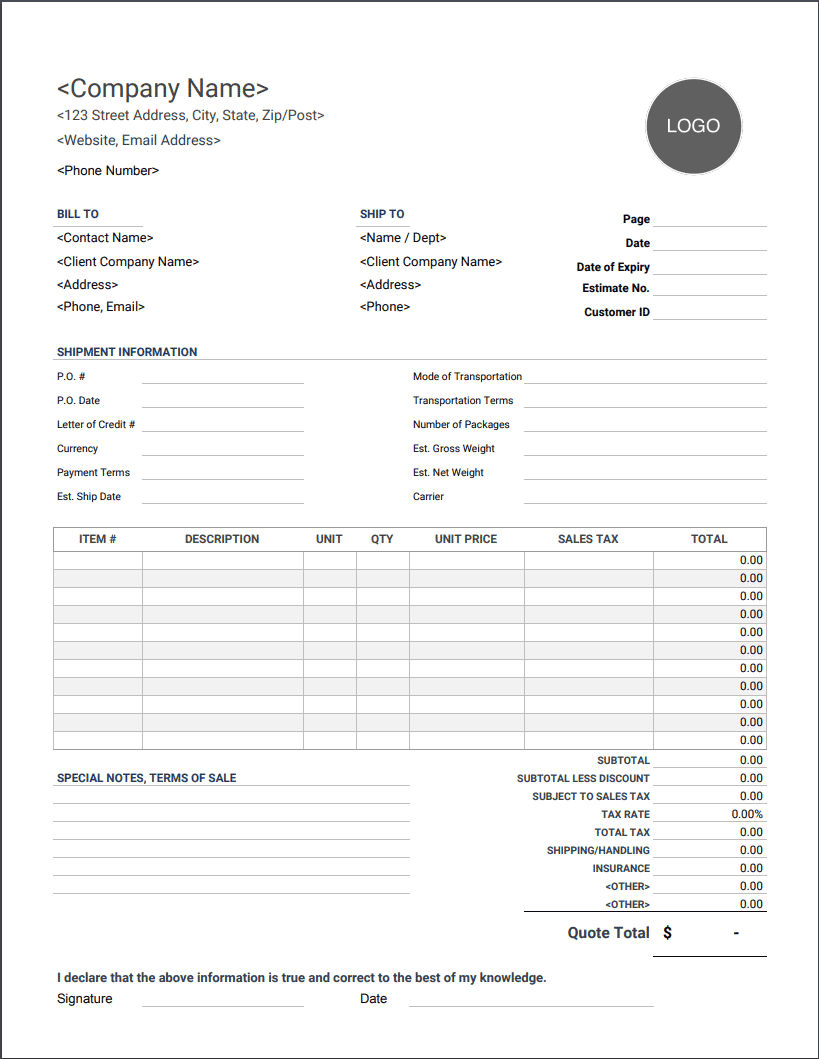

They can figure out how to make the final payment, obtain import licenses, and open a letter of credit, as the situation demands.Ī pro forma invoice is a type of quotation used by international buyers to get their goods released from the port of entry. Once the seller receives it, they prepare a dummy invoice containing the estimated amount to be paid and other relevant details.Įven though it is not an official document, a pro forma invoice allows the importer to prepare for the process ahead. The enquiry is followed by an RFQ (request for quotation). Here, the potential buyer forwards an enquiry informing the seller of their wish to buy the items. The use cases of a pro forma invoice and a tax invoice differ too.Īs the name suggests, a pro forma invoice comes into play before the actual sales occur. Uses of Pro Forma and Commercial Invoices It is a legal document that acts as proof of evidence that the items were sold by the seller to the buyer. The tax invoice is an accurate description of the amount due against the purchases made by the buyer. In addition, it contains an accurate description of the sale price and helps the buyer understand the rough amount they may have to pay before purchasing. It is because it also covers the taxation element, especially customs. Let us delve into these.Ī pro forma invoice is usually used in cross-border transactions. Purpose of Pro Forma and Commercial InvoicesĪ pro forma invoice and a tax or commercial invoice serve different purposes. It includes the cost of the purchased items, shipping and transport charges, taxes, and other relevant monetary items but is not recorded in the books or charged to the buyer. It is in no way a legal document and only informs buyers of the expected final costs pertaining to the order they want to place. When we are unsure of the final expenses, we can request the seller to present us with a pro forma invoice.Ī pro forma invoice is a preliminary bill of the sale generated before shipment or goods delivery. What is a Pro Forma invoice? Image Source: eFormsĮach of us calculates the cost of the items we are to buy before placing the order with the vendor. It includes details such as the name and address of the party, description of items sold, quantity and per-unit cost, total costs, discounts, taxes, and the final amount payable by the buyer. It is a commercial, non-negotiable vehicle that the supplier issues to the buyer.Ī tax invoice displays all the vital information pertaining to the order and the parties involved and acts as legal proof of the transactions that took place between both parties. What is a Tax Invoice? Image Source: NBCĪ tax invoice is an official document. This article discusses the differences between pro forma invoices and tax or commercial invoices for a business. The tax invoice is an official document, whereas a pro forma invoice is a mere representation of the final cost from the seller’s end. Pro forma invoice and tax invoice are often a part of the same order but play a different role for both parties.

Organizations primarily deal in two types of invoices:

Invoicing acts as a form of communication with buyers and enables the smooth conduct of business. Designed for small businesses, this system helps you get paid fast using great-looking invoice templates and online payments.Ĭhoose from our wide range of templates of invoices to make your billing statements better.A business has to deal with several invoice types regularly.

#Instay form estimates and invoice pro download#

You can even download an invoice template that lets you sign up for Microsoft invoicing. You’ll also find invoicing templates and billing statements that deduct deposits or provide tax calculations. With service-specific templates for an invoice, you can enter quantities and unit costs for labor and sales and even adjust the invoice template to double as a receipt. Sales invoicing templates itemize purchases and can calculate totals and special discounts automatically.

#Instay form estimates and invoice pro free#

Easy-to-use and professionally designed, these free invoice templates streamline your administrative time so you can get back to running your business.Įxcel and Word templates for invoices include basic invoices as well as sales invoices and service invoices.

#Instay form estimates and invoice pro professional#

Professional invoice templates to streamline your business billingīilling is a breeze with a Microsoft invoice template.

0 kommentar(er)

0 kommentar(er)